It was established in 1935, and was called, at that time, the “Agricultural Industrial Bank.”

The bank’s objectives were summarized in financing agricultural activity and financing farmers, in addition to industrial activity and its owners, merchants and craftsmen, who tried through their projects to advance the industrial sector in their countries.

With the advent of 1946, the government decided to establish an independent industrial bank to undertake the tasks of financing industrial projects; after that, the bank would specialize in financing agricultural projects only.

Since 2008, the Agricultural Bank has been practicing its activities through a group of important funds, including: (Farmers and Farmers Loans Fund, Palm Tree Development Loan Fund, Rural Women Development Fund, Mechanization Fund, Livestock and Marshlands Development Fund, Agricultural Projects Development Fund for the Sons of Iraq). However, we will discuss in detail here the “Major Projects Fund” as the fund that interests businessmen and investors. What is it? What are its requirements? What does it offer? We will learn about all of this through the following lines:

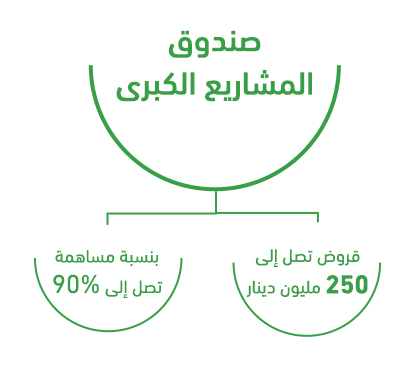

Major Projects Fund:

This fund provides loans to individuals (18-80 years old) and agricultural companies for amounts up to 250 million dinars; it targets dairy, meat and molasses factories, oil factories and places designated for storing agricultural products. Note that the bank’s contribution rate for all loans is 80% except for date warehouses and presses, where the bank’s contribution rate is 90%.

All loans are documented with real estate guarantees that are sufficient to cover the required amount, and in case of insufficiency, they are reinforced with personal guarantees or bills of exchange. It is worth noting that the calculation of loan costs is done according to the economic feasibility study and the instructions of the Department of Animal Wealth and Agricultural Investments.