Key Indicators of the Construction Sector in the GCC

Given the importance of the sector, Mashroo3k Consulting presents the following key indicators of the construction industry across the Gulf Cooperation Council (GCC) countries:

Kingdom of Saudi Arabia

- GDP contribution of the construction sector: 168,750 million SAR.

- Sector’s share of total GDP: 4.66%.

- Number of companies operating in the sector: 148,026 companies.

- Number of employees in the sector: 3,541,977 individuals.

- Value of projects executed (latest statistics): 311,563,369 thousand SAR.

- Saudi Arabia leads the regional market, with an annual construction market value exceeding $100 billion.

United Arab Emirates

- GDP contribution of the construction sector: 123,953 million AED.

- Sector’s share of total GDP: 8.3%.

- Number of companies operating in the sector: 42,428 companies.

- Number of employees in the sector: 1,564,095 individuals.

Kingdom of Bahrain

- GDP contribution of the construction sector: 936.79 million BHD.

- Sector’s share of total GDP: 7.70%.

- In 2016, the sector’s value was 857 million BHD, but within a few years, it grew to 945.51 million BHD.

Sultanate of Oman

- GDP contribution of the construction sector: 1,943 million OMR.

- Sector’s share of total GDP: 6.7%.

- Number of employees in the sector: 548,999 individuals.

- The construction sector employs the highest percentage of workers in Oman, accounting for 22.4% of total Omani employees in both the public and private sectors, and 29.6% of all expatriates working in the country.

State of Kuwait

- GDP contribution of the construction sector: 838.9 million KWD.

- Sector’s share of total GDP: 2.14%.

- Number of companies operating in the sector: 1,502 companies.

- Number of employees in the sector: 187,705 individuals.

State of Qatar

- GDP contribution of the construction sector: 81,215 million QAR.

- Sector’s share of total GDP: 12.1%.

- Number of companies operating in the sector: 5,629 companies.

- Number of employees in the sector: 840,999 individuals.

- The construction sector employs over 40% of Qatar’s economically active population.

- The sector is highly promising, making investment in construction activities highly lucrative due to population growth and ongoing infrastructure development.

- Experts predict that the construction market will grow at a rate of 4.2% over the next three years, with the sector’s total value expected to reach $10.5 trillion by 2023.

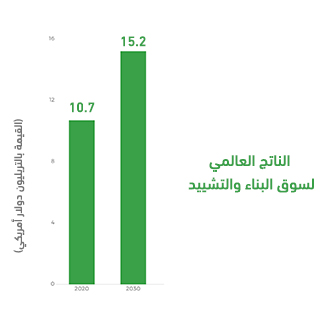

The Global Construction Sector

- In 2020, the global construction output was valued at $10.7 trillion.

- The market is expected to grow by 42% ($4.5 trillion) between 2020 and 2030, reaching a total of $15.2 trillion by the end of the decade.

4o